Accommodation Costs: The Shared Life

Let’s start with what takes up most of any student budget – rent.

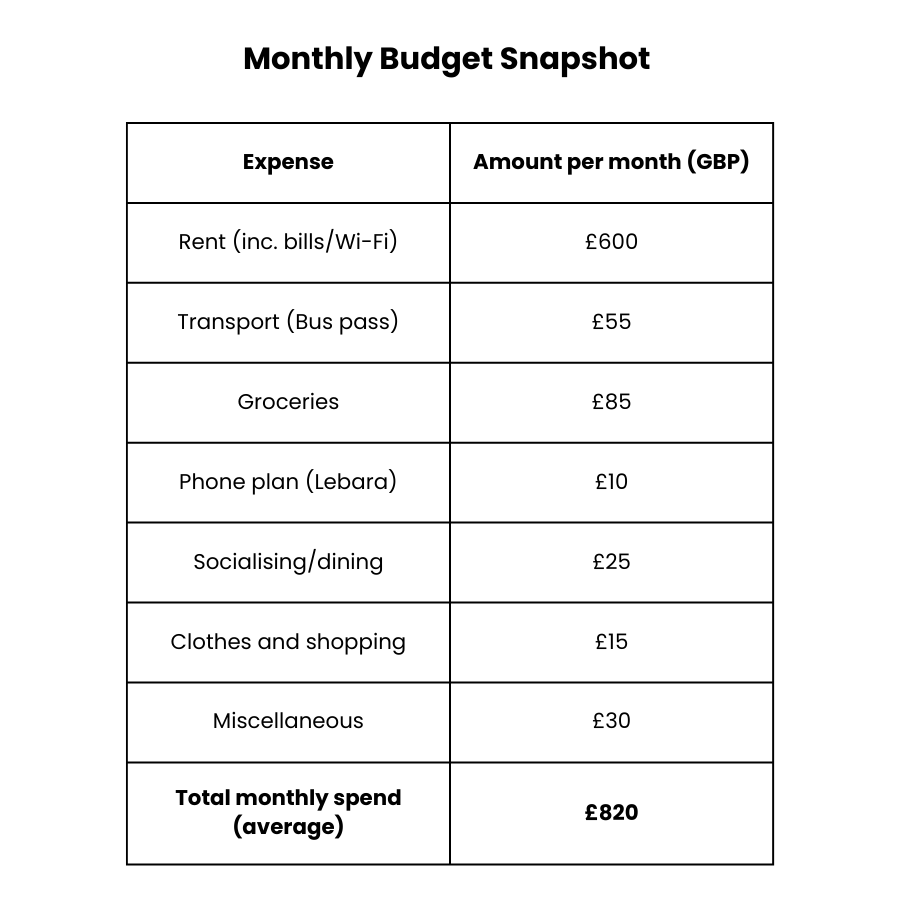

I lived in a shared accommodation in Armley, which cost me £600 per month. This might sound steep, especially considering:

- There were 8 students in the house.

- We had one shared kitchen and only one bathroom (yes, one!).

- The house was functional but far from fancy.

But here’s the upside: the rent included all utility bills and Wi-Fi, which made budgeting easier. No separate bills for heating, electricity, or broadband. In the UK, those can add another £60-£90 per month, so I considered this a win.